Timeblock

| Time (PDT) |

Plan |

Reality |

| 0000 |

SLEEP |

|

| 0030 |

SLEEP |

|

| 0100 |

SLEEP |

|

| 0130 |

SLEEP |

|

| 0200 |

SLEEP |

|

| 0230 |

SLEEP |

|

| 0300 |

SLEEP |

|

| 0330 |

SLEEP |

|

| 0400 |

SLEEP |

|

| 0430 |

SLEEP |

|

| 0500 |

Morning routine |

|

| 0530 |

Coffee and rumination |

|

| 0600 |

|

Pomodoro: Planning |

| 0630 |

Pomodoro: Organization |

|

| 0700 |

Pomodoro: Thinking |

|

| 0730 |

Wake up wife |

|

| 0800 |

Getting ready |

|

| 0830 |

Walk to work |

|

| 0900 |

Stretching |

|

| 0930 |

Start of work routine |

Stretching |

| 1000 |

Pomodoro: Query-time sampling fix |

Start of work routine |

| 1030 |

Pomodoro: Query-time sampling fix |

Slack |

| 1100 |

Pomodoro: Query-time sampling fix |

Flu shot |

| 1130 |

Pomodoro: Query-time sampling fix |

Pomodoro: Devbox shenanigans |

| 1200 |

Buffer |

Candidate lunch |

| 1230 |

Buffer |

Candidate lunch |

| 1300 |

Lunch with friend |

|

| 1330 |

Lunch with friend |

|

| 1400 |

Buffer |

Walk to office |

| 1430 |

NAP |

Ping pong |

| 1500 |

Pomodoro: Weekly Review |

Ping pong |

| 1530 |

Pomodoro: Weekly Review |

Friday hang out |

| 1600 |

Walk home |

Non-pomodoro work |

| 1630 |

Buffer |

Pagerduty |

| 1700 |

Cooking |

Walk home |

| 1730 |

Cooking |

Hanging out |

| 1800 |

Buffer |

Cooking |

| 1830 |

Pomodoro: Cohort Linking |

TV: Overwatch |

| 1900 |

Pomodoro: Cohort Linking |

Eating |

| 1930 |

Hanging out |

Bug exploration |

| 2000 |

Hanging out |

Shower |

| 2030 |

Winding down |

|

| 2100 |

SLEEP |

|

| 2130 |

SLEEP |

|

| 2200 |

SLEEP |

|

| 2230 |

SLEEP |

|

| 2300 |

SLEEP |

|

| 2330 |

SLEEP |

Thinking

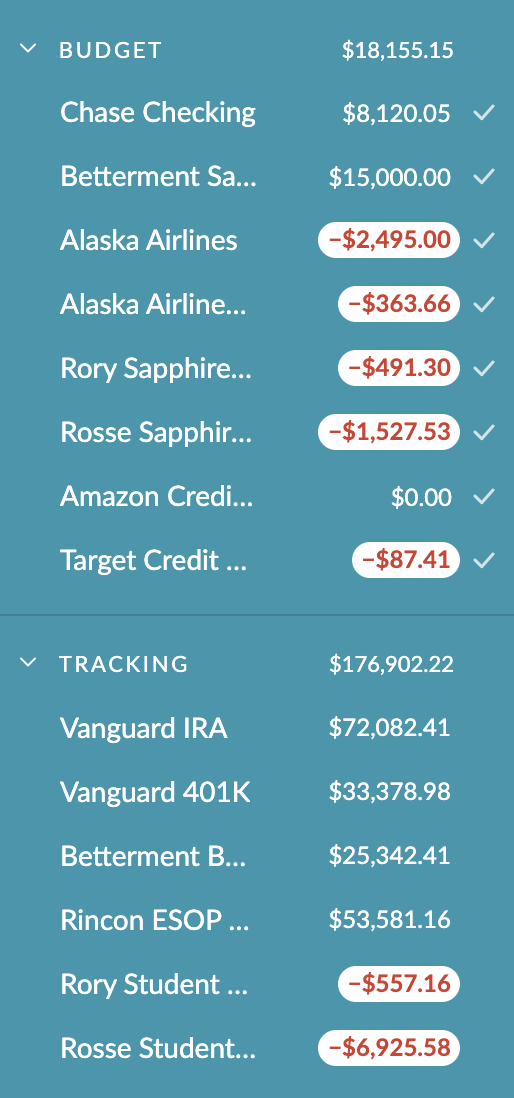

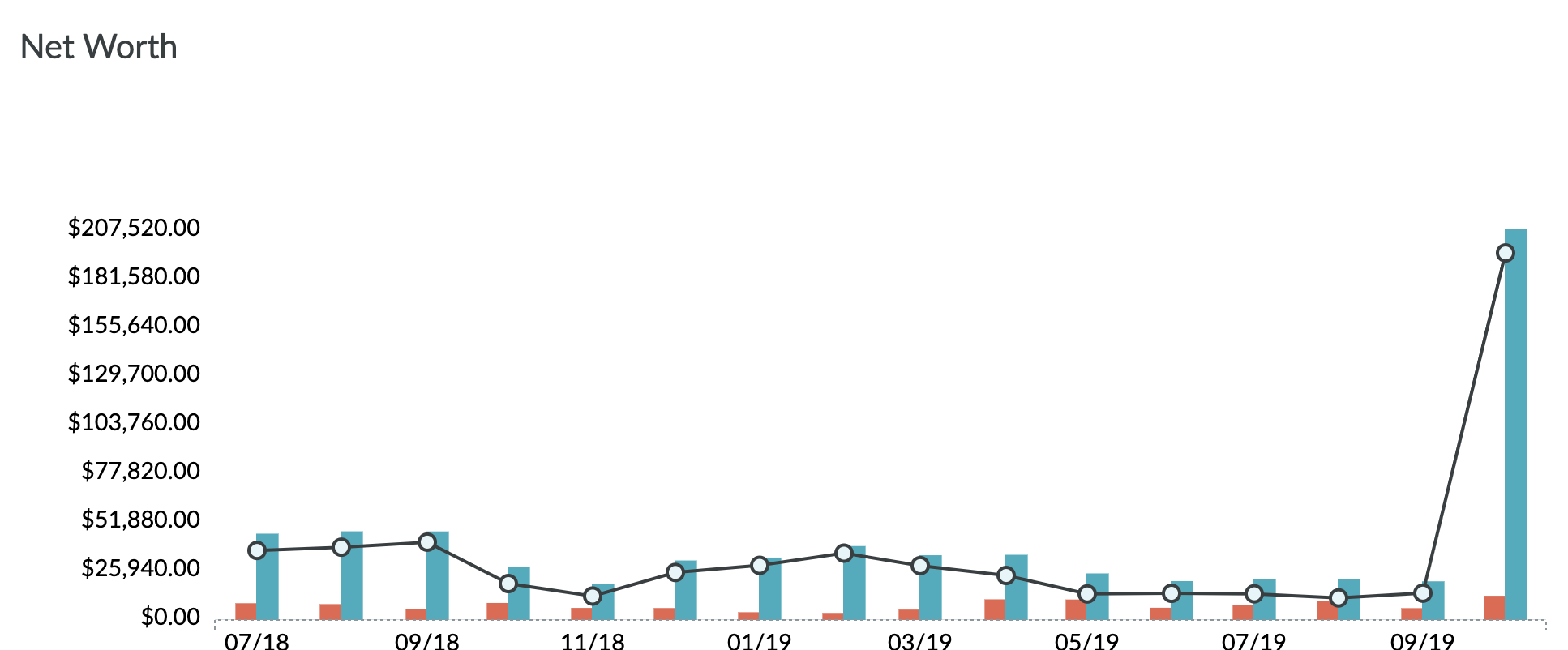

As I've mentioned before... I think, I've developed a budgeting habit now. It

clicked about a month ago, and then I read a book

You Need a Budget,

which is the book by the person who made the

You Need a Budget

app that I'm using.

I believe yesterday I realized that I was falling behind. Or at least further

behind than I thought. Though some of this was due to auto-investing into

betterment, which I have now stopped doing.

I want to do some thinking here to verify that I should have plenty of buffer.

Without further ado.

| Money Flow (average per month) |

Balance |

| Paycheck: ($8129) |

$8129 |

| Wellness benefit: ($100) |

$8229 |

| Rent: $2400 |

$5829 |

| Invisalign: $644 |

$5185 |

| Groceries: $500 |

$4685 |

| Coffee: $250 |

$4435 |

| Student Loan Payments: $200 |

$4235 |

| One-offs: $200 |

$4035 |

| Consumables: $40 |

$3995 |

| Electricity: $50 |

$3945 |

| Internet: $65 |

$3880 |

| Phone: $40 |

$3840 |

| Clothing: $300 |

$3540 |

| Home maintenance: $140 |

$3400 |

| Equipment: $30 |

$3370 |

| Dining out: $200 |

$3170 |

| My Tools: $20 |

$3150 |

| Wife's Tools: $200 |

$2950 |

| Medical: $1000 |

$1950 |

| Fitness: $100 |

$1850 |

| Just for Fun: $200 |

$1650 |

| Transportation: $110 |

$1540 |

| Tucson property: $200 |

$1340 |

| Quakecon: $300 |

$1040 |

| Thanksgiving: $150 |

$890 |

| Tucson visit: $40 |

$850 |

| Christmas: $150 |

$700 |

| Therapy: $100 |

$600 |

| Moving: $100 |

$500 |

All right, this is average monthly flow, fairly accurately, based on definitely

monthly expenses and average monthly expenses according to YNAB. I've rounded

up in most-cases. Medical expenses, for instance, should start shrinking per

month, I think. Though maybe I should keep budgeting $1000 a month for it.

Medical expenses happen, and in a sense they're an investment, anyways.

Figuring out medical issues now means they cause less friction in the future,

and the wife and I can make compound interest on what is gained the sooner

medical things are dealt with, however little we can deal with them to begin

with.

"One-offs" are things I buy once. It seems I buy a thing "only once" about $200

worth a month. A couple months ago it was a portable AC. This month, blinds for

windows. This is a "know your true expenses" sort of thing. Might as well keep

putting $200 in there per month.

Groceries might actually slowly be shrinking per month. We'll see. At the rate

we're going this month, it should be $400.

Coffee is an agreed-to high-number as it gives the wife an anxious-free bit of

time outside the house.

Technically, I've saved up enough to pay off student loans. And I have that

money in an index fund. It on-average out-performs the student loan interest,

so it's a net gain. I pay the minimum per month. I'm paid ahead in case I need

to stop for a little bit for whatever reason. I look at this setup as a way to

reloan myself money at 3.5% interest, and that I'm actually saving $200 per

month, in a sense. I think it works out. Though, once I pay off the student

loans, I plan on maintaining the payment, but putting it right into an index

fund. Avoid that income inflation, yo.

I have the same plan when I pay off the Invisalign.

Rent is actually pretty steep, but it was something we were willing to pay for.

I have been thinking, though, at this cost, could it be worth it to buy a piece

of property? There are several things to consider when answering this question:

- interest lost moving capital from index fund to down payment

- average cost of upkeep in house

- principle being paid down per month

- interest being paid per month

- fixed house payments (insurance, taxes, etc.)

So, based on what some initial research shows, I could own a similar house to

what I own and have an average monthly cost maybe as little as $2000 with a

$100,000 down payment. That down-payment amounts to about $584 lost interest

per month ($7000 a year assuming 7% yield). Principal would be, ballpark, one

sixth of the mortgage payment overall (for the first year, at least), and the

mortgage payment would be something like $1700 (the other $300 towards taxes

and insurance). So $280 "saved" in principal payments (in that I own that much

more of the house). That's savings that won't gain substantial interest though

(on average, houses grow at the rate of inflation).

But that's $680 ($280 "saved" in principal and $400 saved by decreasing monthly

costs) over $584 "lost" in interest from money that would be in an index fund.

Really, I guess this boils down to:

- What's the minimum house we'd be happy to live in?

- Is that house cheaper to own or to rent based on the above criteria?

I believe the wife and I can explore this question tomorrow during our budget

date. As well as how malleable the above spending is.

I need to go to work now.